The Risks and Rewards of Accounts Receivable Factoring

by Treva Rau

The Rewards and Risks of Accounts Receivable Factoring

Small businesses often face challenges in securing traditional financing options such as loans and credit cards, which often come with stringent requirements and monthly repayment obligations. In such situations, accounts receivable factoring emerges as a viable alternative, offering quick access to much-needed cash flow without the complexities associated with traditional lending.

Understanding Accounts Receivable Factoring

Accounts receivable factoring is a financial practice that enables businesses to unlock cash from outstanding invoices promptly. By selling their unpaid invoices to a third-party factoring company, businesses can obtain immediate funds to cover essential expenses like payroll, inventory replenishment, and expansion initiatives. Unlike traditional loans, factoring does not create debt on the company's balance sheet and has no impact on its credit rating, making it an attractive option for businesses with less-than-perfect credit histories.

At Ratio Tech, we understand the significance of accounts receivable factoring in empowering businesses to maintain financial stability and drive growth. As Victor Thu, our Chief Marketing Officer, highlights, "Factoring allows businesses to convert their accounts receivable into immediate cash, providing the liquidity needed to seize new opportunities and weather unexpected challenges."

The Benefits of B2B BNPL

While consumer markets have long embraced buy now, pay later (BNPL) options, the adoption of BNPL in the B2B space has been relatively slower. However, technological advancements have facilitated the rise of B2B BNPL solutions, offering businesses greater flexibility in managing cash flow and financing purchases.

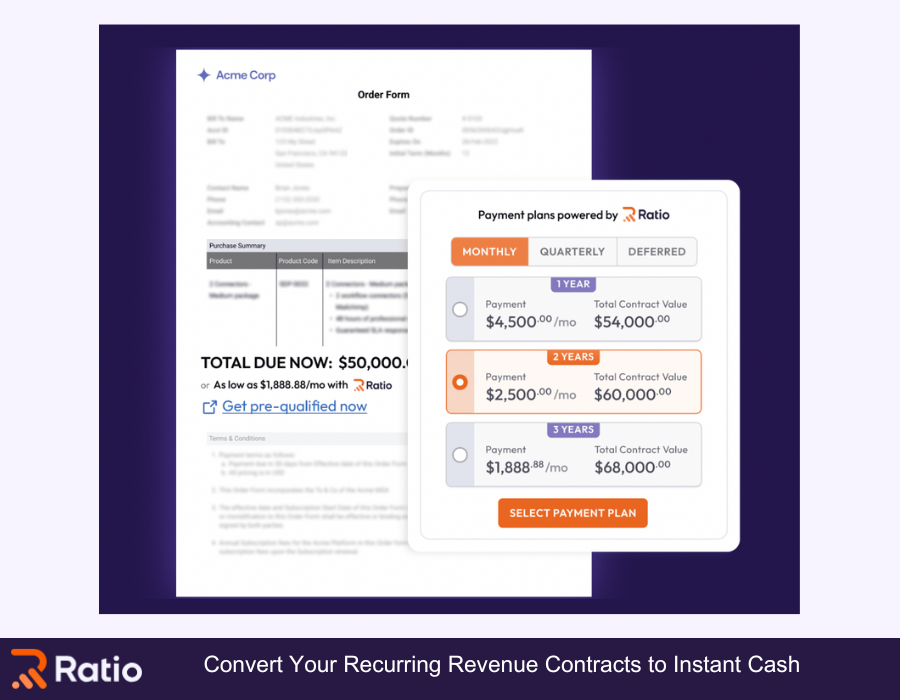

B2B BNPL solutions, like those offered by Ratio Tech, provide businesses with the ability to defer payments for a specified period, typically 30 or 60 days post-invoice. This allows businesses to optimize their working capital, maintain operational efficiency, and spread the costs of investments over time. As Victor Thu emphasizes, "BNPL can significantly shorten sales cycles and boost cash flow, enabling businesses to expand more rapidly while preserving liquidity."

Managing Cash Flow with Factoring

Factoring presents an effective means for businesses to address cash flow challenges associated with slow-paying customers and seasonal revenue fluctuations. By selling their invoices to a factoring company, businesses can accelerate their cash cycle and access immediate funds to support ongoing operations and growth initiatives.

At Ratio Tech, we've witnessed firsthand how factoring can transform the financial landscape for businesses. Our factoring solutions provide businesses with the liquidity needed to navigate cash flow fluctuations and capitalize on growth opportunities. As Victor Thu explains, "Factoring allows businesses to release capital tied up in accounts receivable, empowering them to invest in expansion initiatives and seize new opportunities."

Evaluating Credit Risks

While factoring offers numerous benefits, it's essential for businesses to carefully evaluate the associated credit risks. Factoring companies typically assess the creditworthiness of a business's customers before advancing funds, helping mitigate the risk of defaults and delinquencies.

Ratio Tech's factoring solutions are designed to minimize credit risk and maximize value for our clients. Through rigorous credit assessment processes and ongoing risk management strategies, we ensure that businesses can leverage factoring as a reliable source of working capital without compromising their financial stability.

Leveraging Factoring for Growth

Factoring can serve as a catalyst for business growth by providing businesses with the capital needed to pursue expansion initiatives and investment opportunities. Whether it's funding new projects, expanding product lines, or entering new markets, factoring offers businesses the flexibility to pursue growth without the constraints of traditional financing options.

At Ratio Tech, we partner with businesses to unlock their full potential through tailored factoring solutions. Our team of experts collaborates closely with clients to understand their unique needs and develop customized financing strategies that drive sustainable growth. As Victor Thu affirms, "Ratio Tech's factoring solutions empower businesses to accelerate growth and achieve their long-term objectives."

Maximizing Rewards Through Strategic Factoring

Strategic factoring can yield significant rewards for businesses, from improved cash flow and reduced bad debt to greater financial flexibility and resilience. By partnering with a trusted factoring provider like Ratio Tech, businesses can unlock the full benefits of B2B buy now pay later factoring while minimizing risks and maximizing returns.

Ratio Tech's commitment to excellence and innovation sets us apart as a leader in the factoring industry. With our comprehensive suite of factoring solutions and personalized approach to client engagement, we empower businesses to thrive in today's competitive landscape. Contact us today to learn more about how Ratio Tech can help your business achieve its financial goals.

The Rewards and Risks of Accounts Receivable Factoring Small businesses often face challenges in securing traditional financing options such as loans and credit cards, which often come with stringent requirements and monthly repayment obligations. In such situations, accounts receivable factoring emerges as a viable alternative, offering quick access to much-needed cash flow without the complexities…

Recent Posts

- Expert Lawn Care Lubbock Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal

- Expert Lawn Care Lubbock Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal

- My Insurance Agent TX Urges Drivers in Midland Odessa to Opt for Adequate Auto Liability Coverage Over State Minimums

- Boundless SEO Emerges as the Premier Los Angeles SEO Expert, Offering Top-Tier Services for Local Businesses

- Lawn Care Spring Branch Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal